FINANCIAL PLANNING

Financial Freedom

The key to financial freedom and great wealth is a person's ability or skill to convert earned income into passive income and/or portfolio income.

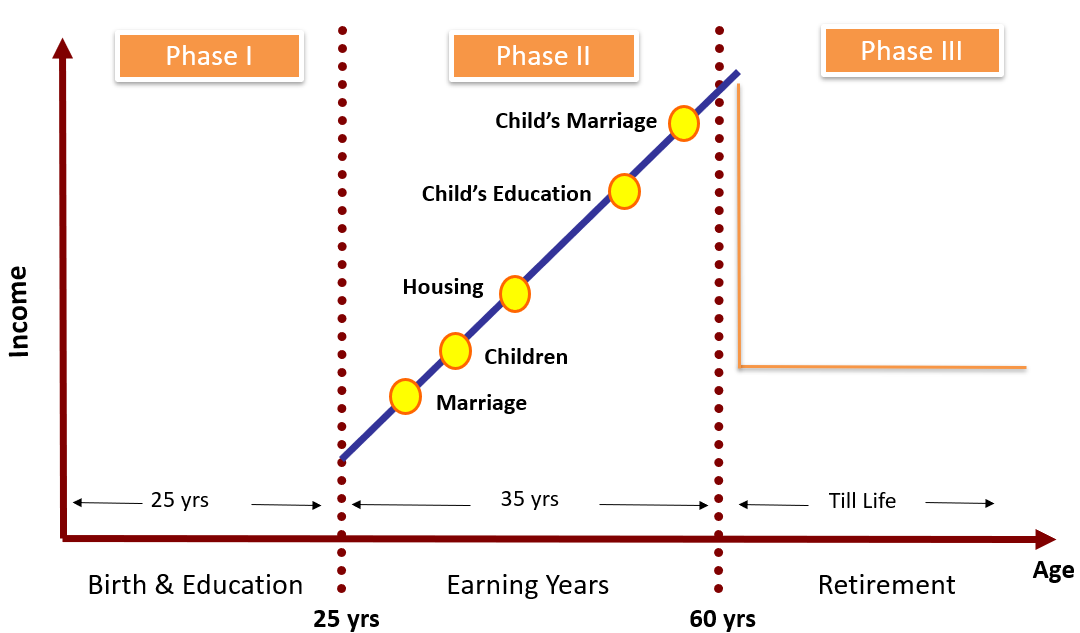

Life Cycle Stages

Life cycle - a series of stages through which an individual passes during his or her lifetime.

We follow a multi-disciplinary method of wealth management and mutual funds are a part of it. AnuPal Investments help the clients in mutual fund investment with proper guidance and personalized investment solutions.

We are aggregated mutual fund distributor with all of the leading mutual fund providers. Our clients are provided with anytime access to their portfolios and regular reports are shared on a predefined frequency.

Mutual Fund Advice

We help the investors in understanding mutual funds and why one should invest through mutual funds.

Further to this, we provide guidance in picking the best mutual fund as per their financial plan and also educate our investors on how to monitor their mutual fund investments.

AnuPal Investments believes in empowering the investors. Therefore, we help our clients understand and evaluate mutual funds and the probability of earning best possible returns from their Mutual Fund Portfolio.

The idea is to help you by providing, the appropriate and Best Mutual Fund advice as per your financial goal & Risk appetite

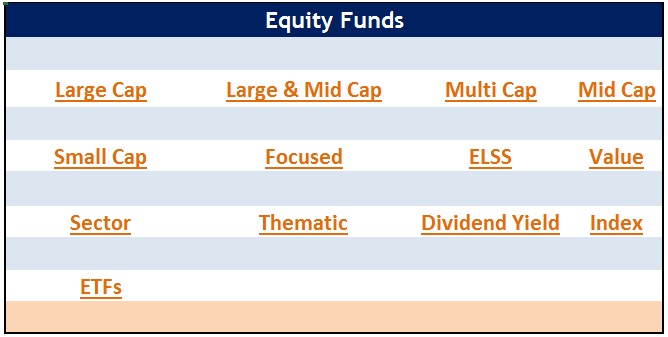

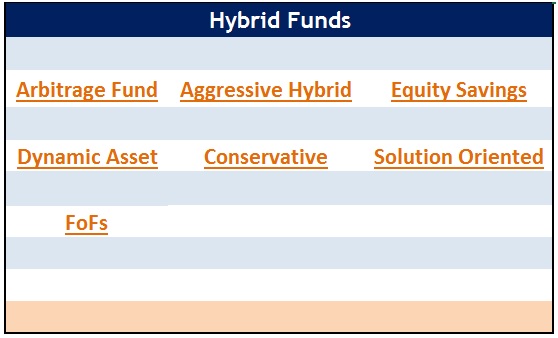

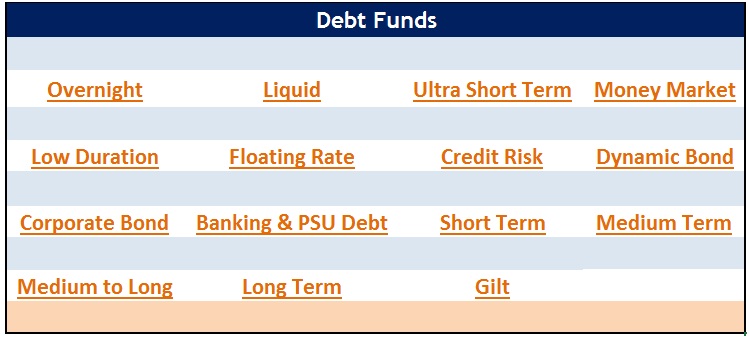

Types of Mutual Fund

1) Equity Mutual Fund

2) Hybrid Mutual Fund

3) Debt Fund

With increased life span and shortening of income period, every person has to plan his retirement. At AnuPal Investments, we work along with our clients in providing retirement solutions, ensuring benefits during the entire retirement period.

It is important to plan retirement in such a way that the same lifestyle can be maintained. But to achieve that, one has to plan it well in advance. Ideally one must start retirement planning from the very first day he/she starts earning. Your earnings today should become savings for the future without compromising on the present living conditions as well. We help our clients in managing mutual funds with active management which results in them attaining their long term financial objectives.

Apply now

Education costs are on the rise and continue to be on the high end each year. As your kids grow old and start pursuing higher education, there is a significantly higher education cost involved. And to provide for this, we need to plan it in advance. The main purpose behind planning education expenses is availability of required amounts at required time and no dependability on education loans. At AnuPal Investments, we help bring your child's dreams come true.

While planning this goal, having an experienced financial advisor at your side, you will be able to determine well on how to fit your educational goals into your financial planning.

If you are looking for your children to have the best option for their higher education, contact AnuPal Investments now!

Apply now